Pasar Saham Shanghai dan Tokyo Kembali Terjungkal Akibat `Keruntuhan China`

Great Fall of China: Shanghai and Tokyo Markets Plummet for a Second Day

Editor : Ismail Gani

Translator : Novita Cahyadi

KEPANIKAN melanda perekonomian dunia akibat pelambatan ekonomi

China yang berdampak hebat pada pasar keuangan global, terjadi akibat

pasar saham China anjlok 8,5% hanya dalam sehari. Pagi ini, saham

Shanghai anjlok 6,41% pada awal perdagangan.

Dana hampir 75

miliar poundsterling dari perusahaan-perusahaan terkemuka di Inggris

menguap kemarin, yang disebut sebagai hari terburuk bagi pasar saham

London sejak Maret 2009 - ancaman menuju Resesi Besar.

Aksi

melepas saham - terjadi di seluruh pasar saham Asia, Eropa, dan Amerika

Serikat - terjadi setelah pasar saham China anjlok 8,5% dan disebut

sebagai 'Kejatuhan Terbesar China'. Para analis keuangan

menggambarkannya sebagai 'hari kepanikan terbesar' di pasar global.

Pagi ini, saham Shanghai kembali anjlok 6,41% pada awal perdagangan, sementara saham Tokyo juga turun 4,13%.

Indeks

Komposit Shanghai melorot 3,004.13 poin di menit pertama perdagangan,

terkoreksi 4,33% pada saat break. Indeks Komposit Shenzhen saham juga

merosot lebih dari 6% pada awal perdagangan.

Senin malam, Kanselir George Osborne memperingatkan bahwa Inggris 'tidak kebal' terhadap krisis, seperti dilansir MailOnline.

Dan

mantan Menteri Keuangan AS, Larry Summers pada Senin malam

memperingatkan ancaman terhadap ekonomi global, katanya hal itu 'dapat

menjadi tahap awal dari situasi yang sangat serius' - seperti pada 2008

ketika sistem perbankan dunia di ambang keruntuhan.

Dia meyakini

semalam bahwa lebih dari satu triliun dolar AS menguap dari nilai saham

di seluruh dunia dan dinyatakan sebagai 'Black Monday'.

Ada

spekulasi bahwa kerapuhan dari ekonomi dunia dapat menunda langkah Bank

of England untuk menaikkan suku bunga dalam beberapa bulan mendatang.

Osborne

memperingatkan 'sifat terbuka Inggris' yang saat ini menikmati

investasi miliaran poundsterling dari China, menyiratkan langkah

pemulihan ekonomi masuk kategori bahaya.

Dan dia mengatakan

kondisi turbulen menegaskan kebutuhan untuk memulihkan kondisi finansial

Inggris. "Semua orang prihatin terhadap pasar keuangan Asia," kata

Osborne saat berkunjung ke Helsinki.

Kekhawatiran terhadap

pelambatan ekonomi dan kondisi pasar saham China telah dikhawatirkan

sejak berbulan-bulan lalu. Pemerintah komunis yang campur tangan dalam

beberapa hari terakhir untuk mengatasi kondisi perekonomian dengan

mendevaluasi mata uangnya.

Namun kemarin dampak devaluasi

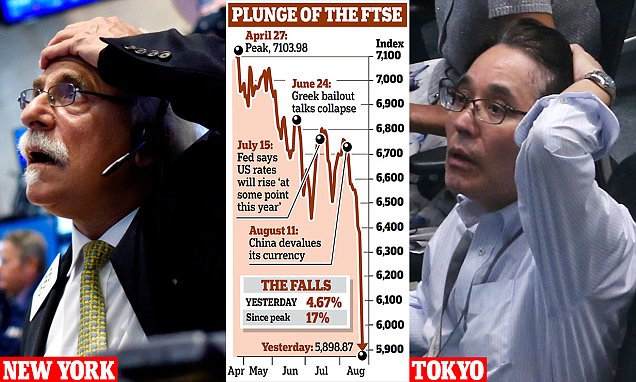

sangatlah mengejutkan. Indeks FTSE 100 jatuh hingga 6,6% sebelum ditutup

288,78 poin atau 4,67% di 5.898,87 kemarin.

Akibatnya 73,9

miliar poundsterling menguap dari nilai saham perusahaan blue-chip di

Inggris seperti Vodafone dan British Petroleum hingga Rolls-Royce dan

Marks & Spencer.

FTSE yang dijuluki The Footsie kini berada

di tingkat terendah sejak akhir 2012 setelah kehilangan 214,2 miliar

poundsterling dari total saham hanya dalam 10 hari - aksi jual

terpanjang dalam sejarah merosotnya nilai saham selama 11 hari pada

Januari 2003. Hal ini mengakibatkan 17% dari nilai saham atau 308,3

miliar poundsterling sejak menghantam semua saham bernilai tinggi di

atas 7100 hanya empat bulan yang lalu.

Ini adalah bencana bagi

sebagian besar pekerja yang tergantung pada dana pensiunnya. Dana

pensiun mereka yang diinvestasikan di pasar saham melalui terkait dengan

Footsie.

David Madden, seorang analis pasar di perusahaan

perdagangan City IG, mengatakan: 'Kepanikan yang dimulai di Cina sangat

menular. Pasar saham Eropa telah hancur oleh rasa takut bahwa China akan

runtuh. Lautan merah di layar perdagangan mengingatkan krisis kredit.

Dealer tidak tahu apa yang harus dilakukan karena pasar bergerak sangat

besar dan tidak menentu. "

Kekacauan di London bergema di Eropa

di mana Dax anjlok 4,7 persen di Frankfurt dan Cac turun 5,4 persen di

Paris. Di Wall Street, Dow Jones Industrial Average anjlok lebih dari

1.000 poin pada awal perdagangan sebelum memicu beberapa kerugian.

Jeremy

Cook, kepala ekonom di perusahaan mata uang World First,

menggambarkannya sebagai 'hari panik besar' di pasar global akibat

kekalahan di Cina mengirimkan gelombang kejutan di seluruh dunia.

Mike

McCudden, seorang analis di broker saham Interaktif Investor,

mengatakan: 'Dampak The Great Fall of China akan diingat sebagai mimpi

buruk dari investor di seluruh dunia. Kami telah menyaksikan pembantaian

ketika indeks ekuitas di seluruh dunia jatuh seperti kartu domino.'

David

Buik, analis pasar di broker saham Panmure Gordon, mengatakan: 'Kondisi

akan tetap sangat fluktuatif sampai Natal. Ini adalah berita putus asa

bagi nasabah bank dan pemilik dana pensiun."

Pasar khawatir pada

penurunan tajam dalam perekonomian Cina serta prospek suku bunga yang

lebih tinggi di AS dan Inggris dan krisis di Yunani.

Cina adalah ekonomi terbesar kedua di dunia - dan pasar ekspor terbesar keenam di Inggris.

PANIC OVER over China's slowing economy tore through global

financial markets. Came after the Chinese stock market plunged 8.5 per

cent in a single day. This morning, Shanghai stocks tumbled 6.41 per

cent in early trading.

Markets have plummeted in Asian markets

for a second day as China's slowing economy continues to tear through

financial markets around the world.

Nearly £75billion was wiped

off the value of Britain’s leading companies yesterday, on what was the

worst day for the London stock market since March 2009 – in the depths

of the Great Recession.

The sell-off – which was mirrored across

Asia, Europe and the United States – came after the Chinese stock

market plunged 8.5 per cent on what was named as ‘The Great Fall Of

China’. Analysts described ‘a day of massive panic’ on global markets.

This morning, Shanghai stocks tumbled a further 6.41 per cent in early trading, while Tokyo shares also fell 4.13 per cent.

The

Shanghai Composite Index fell to 3,004.13 in the first minutes of

trading, but were down 4.33 percent by the break. The smaller Shenzhen

Composite Index also slumped more than 6 percent in early trading.

Elsewhere,

other Asian markets were rebounding with Japan's Nikkei reversing early

losses and rising 0.5 per cent to 18,620.89. Hong Kong's Hang Seng

added 1.1 per cent while South Korean and Australian stocks also gained.

Last

night, Chancellor George Osborne warned that Britain was ‘not immune’

from the crisis, which he described as a ‘cause for real concern’.

And

former US Treasury Secretary Larry Summers last night sounded the alarm

about the threat to the global economy, saying it ‘could be in the

early stages of a very serious situation’ – as it was in 2008 when the

banking system stood on the brink of collapse.

It was believed

last night that more than one trillion US dollars (£634billion) had been

wiped from the value of shares worldwide on what other commentators

described yesterday as ‘Black Monday’.

There was speculation that

the fragile nature of the world economy could delay any move by the

Bank of England to raise interest rates in the coming months.

Mr

Osborne warned the ‘open’ nature of Britain’s economy, which now enjoys

billions of pounds of investment from China, meant the recovery could be

put in jeopardy.

And he said the turbulent conditions underlined

the need for restoring order to Britain’s battered public finances.

‘Everyone’s concerned about the situation in Asian financial markets,’

Mr Osborne said during a visit to Helsinki.

Concern about

China’s slowing economy and over-inflated stock market has been growing

for months. Its communist government has intervened in recent days to

try to take the heat out of the situation by devaluing its currency.

But

yesterday the bubble appeared to burst. The FTSE 100 index tumbled as

much as 6.6 per cent before closing down 288.78 points or 4.67 per cent

at 5898.87 yesterday.

The slump wiped £73.9billion off the value

of blue chip companies as household names from Vodafone and BP to

Rolls-Royce and Marks & Spencer saw their share prices slashed.

The

Footsie is now at its lowest level since the end of 2012 having lost

£214.2billion of value in just ten days – the second longest sell-off in

history following an 11-day slump in January 2003. It has lost 17 per

cent of its value or £308.3billion since hitting an all-time high above

7100 just four months ago.

It is a disaster for the vast majority

of workers with pensions. Their nest eggs are exposed to the stock

market through funds linked to the Footsie.

David Madden, a

market analyst at City trading firm IG, said: ‘The panic that started in

China is highly contagious. European stock markets have been crushed by

the fear that China is about to crumble. The sea of red on trading

screens is reminiscent of the credit crisis. Dealers don’t know what to

do with themselves because the market moves are so enormous and

erratic.’

The mayhem in London was echoed in Europe where the Dax

tumbled 4.7 per cent in Frankfurt and the Cac was down 5.4 per cent in

Paris. On Wall Street, the Dow Jones Industrial Average tumbled more

than 1,000 points in early trading before clawing back some of the

losses.

Jeremy Cook, chief economist at currency firm World

First, described it as ‘a day of massive panic’ on global markets as the

rout in China sent shockwaves around the world.

Mike McCudden,

an analyst at stock broker Interactive Investor, said: ‘The impact of

The Great Fall of China will be remembered in the nightmares of

investors the world over. We have witnessed carnage as equity indices

the world over fell like dominoes.’

David Buik, a markets analyst

at stock broker Panmure Gordon, said: ‘Conditions will remain very

volatile up until Christmas. This is such dispiriting news for savers

and pensioners.’

Markets have been spooked by a sharp slowdown in

the Chinese economy as well as the prospect of higher interest rates in

the US and the UK and the crisis in Greece.

China is the world’s second largest economy – and Britain’s sixth biggest export market.